Award-winning PDF software

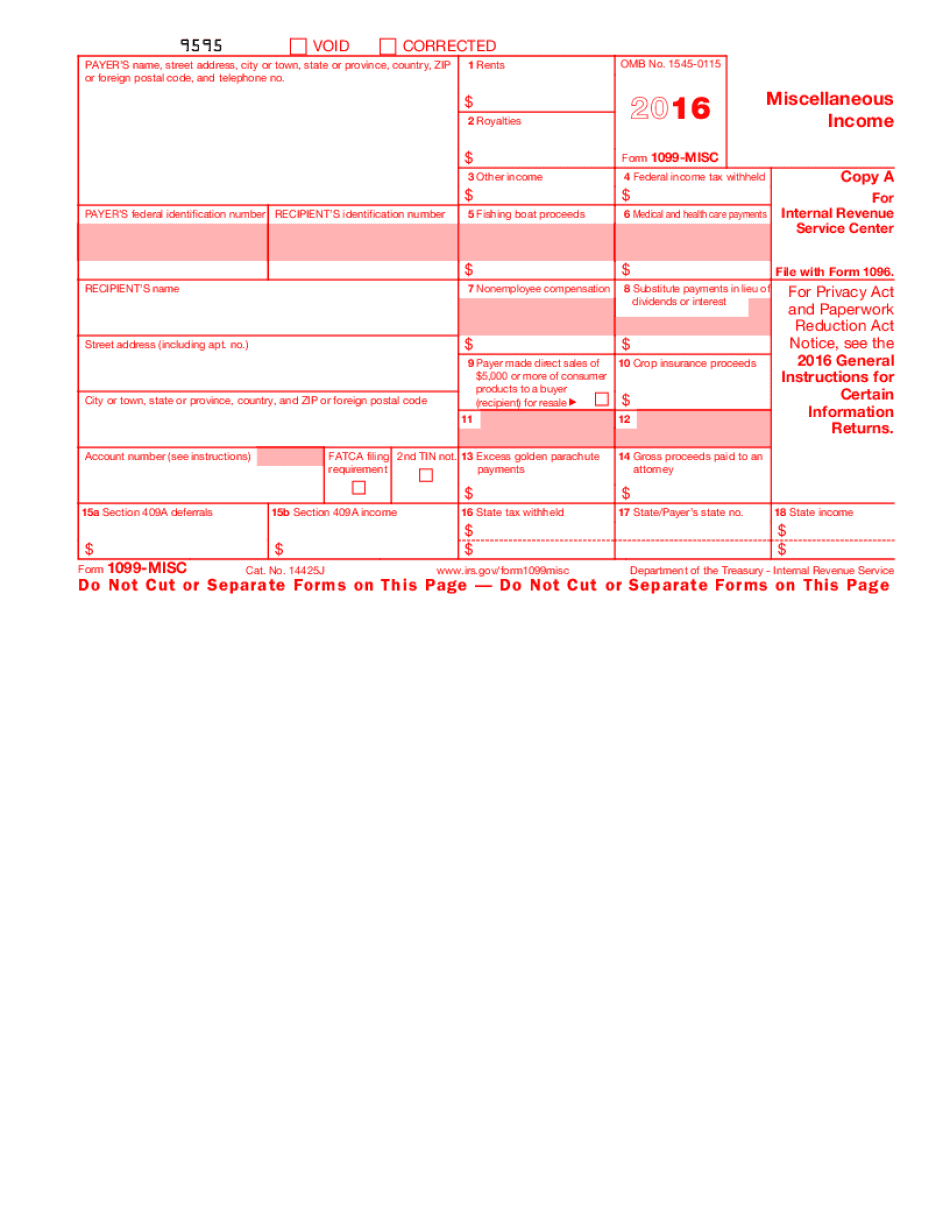

2022 IRS 1099-MISC online Fargo North Dakota: What You Should Know

According to the Commissioner, the increase in tax revenues was due largely to the following: • Excise and license fees, which were up 22.6% • Property taxes, which were up 11.8% • Excise and license fees and interest, which were up 7.4% The Commissioner also noted several factors driving the increase: • Tax revenue generated at the state level has increased dramatically in recent years — due in large part to the sharp drop in oil and gas prices — and as a result, more sales and purchases are taxed than in 2008. • The North Dakota Department of Revenue has made adjustments to its business processes to make them more responsive to the shifting tax climate in the state. The Commissioner said these include increasing the processing time to service all returns to three business days; adding an e-file feature the Department uses to electronically submit returns; and making sure customers are always able to receive their receipt from the state within 24 hours. • Another aspect making returns more timely and less costly for taxpayers is increasing reliance on online payment processing. Under the “Pay Online Now” initiative, an estimated 60 percent of people filing their tax returns online with the tax department are receiving tax refunds within 90 days of submitting their return. News Releases Filing and payment dates, filing deadline for information returns, tax preparers, filing for refund, tax deductions and sales and purchases for fiscal year 2, tax liability report, tax filing and payment dates, filing for information returns, tax preparers, tax filing for the fiscal year 2022, taxes due, filing and payment dates, tax liability report, tax preparation tips for taxpayers, filing of information returns, tax liability report, filing taxes due, tax preparation tips for taxpayers, state and federal income tax returns for the fiscal year 2022, taxable sales and purchases, tax preparation tips for taxpayers, filing for taxes due, tax liability report, tax preparation tips for taxpayers, filing information returns, taxable sales and purchases, tax preparation tips for taxpayers. The Office of State Tax Commissioner in North Dakota has released the following information for the period of January 2025 to December 31, 2017. News Releases Tax Due Dates (Effective July 1, 2022, and after) The tax due date for any tax return depends on the filing status that the taxpayer filed.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete 2025 1099-MISC online Fargo North Dakota, keep away from glitches and furnish it inside a timely method:

How to complete a 2025 1099-MISC online Fargo North Dakota?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your 2025 1099-MISC online Fargo North Dakota aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your 2025 1099-MISC online Fargo North Dakota from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.