Award-winning PDF software

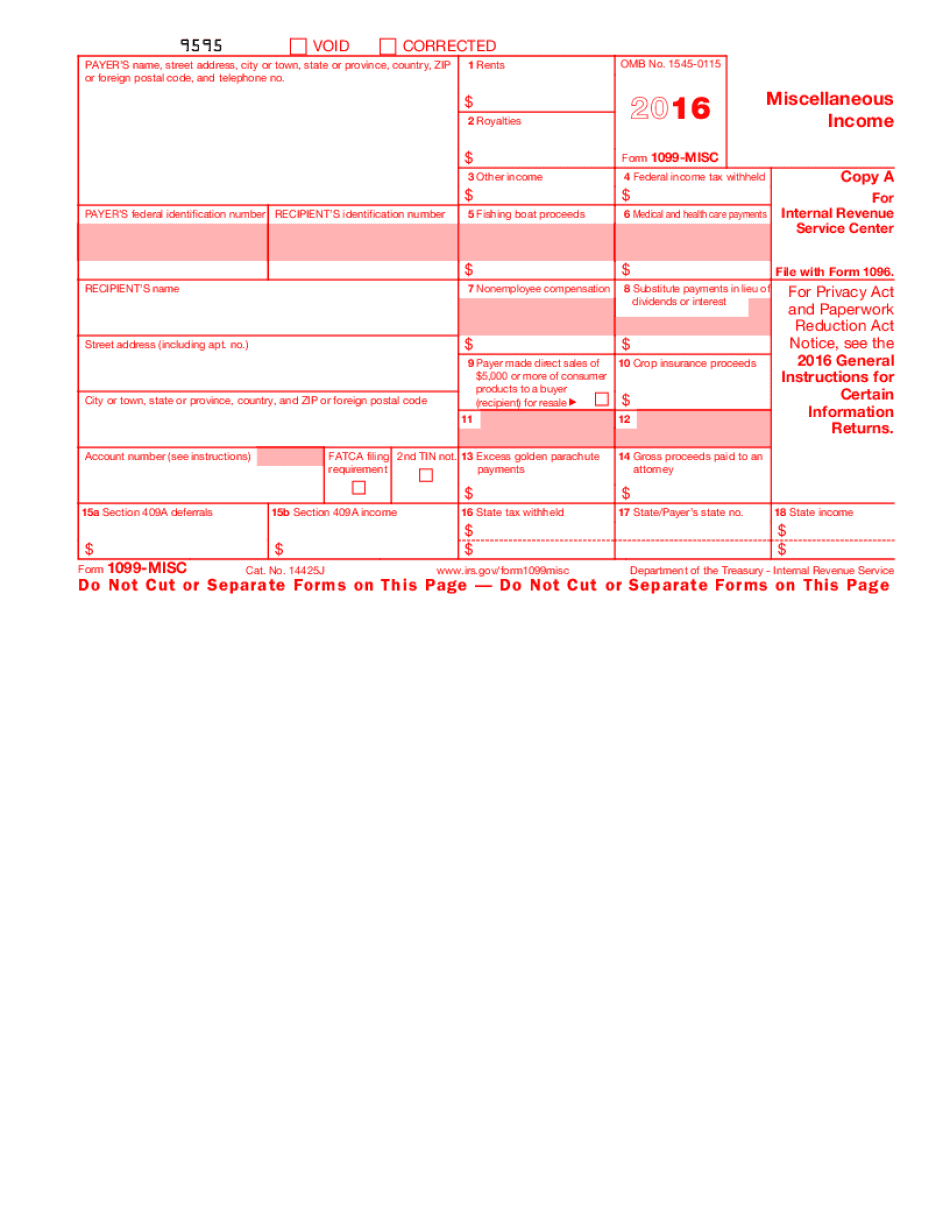

Spokane Valley Washington 2025 IRS 1099-MISC: What You Should Know

New Form 1099-Q, Quarterly and Triennial Returns. For information on this revised form for tax years 2025 through 2029, see the following. Publication 553, Reporting and Paying Taxes: Tips to Help You File. 2029 Income Tax Returns. For information on this revised form for tax years 2025 through 2029, see the following. Publication 550, Annual Return for Individuals and Businesses. Publication 552, Tax Withholding: Questions and Answers. Publication 559, Tax Guide for Individuals. Publication 590, Retail Sales Tax. Form 1099-MISC Income | Washington Department of Revenue Where, when, who pays the tax on purchases of real or personal property under this title? The tax is due and payable on the purchase price of the property. If the property was acquired under this title directly or indirectly from the United States pursuant to a contract, the tax is due and payable to the taxpayer on the original purchase price plus all premiums, additional payments, and other expenses which the taxpayer has recognized on the basis of a contract. The amount included in gross income on the return of the taxpayer's compensation for services for any taxable year shall constitute the taxpayer's share of such tax. See IRC § 61.1 and the Code. Exhibit 3 State and federal sales tax regulations. The State of Washington has adopted state tax law and rules related to sales tax. IRC § 6166(b) provides for a special exemption of certain sales of real or personal property made by a farmer to his employees to allow them to use this property on a farm instead of the regular residential use it would otherwise be granted. IRC § 6655(c)(8) provides that the sales tax shall be paid on taxable sales by manufacturers. IRC § 6655(b) provides that the tax imposed under IRC § 6655(a) shall be imposed only on the sale on or before July 5th of each year by certain dealers in agricultural commodities. IRC § 6655(a) provides the exception to this requirement. Washington provides for a special tax that is collected at the time of sales of real or personal property, but is not subject to special collection procedures in sections 6166 and 6501 of the federal income tax code. This section of the law applies whether the sales tax is collected by the seller or the buyer on the basis of a contract, or without a contract, and regardless of any contract. The sales tax is collected on the basis of the value of the purchase price.

Online methods assist you to arrange your doc management and supercharge the productiveness within your workflow. Go along with the short guideline to be able to complete Spokane Valley Washington 2025 1099-MISC, keep away from glitches and furnish it inside a timely method:

How to complete a Spokane Valley Washington 2025 1099-MISC?

- On the web site along with the sort, click Commence Now and go to your editor.

- Use the clues to complete the suitable fields.

- Include your personal info and contact data.

- Make certainly that you simply enter right knowledge and numbers in ideal fields.

- Carefully verify the articles from the type in addition as grammar and spelling.

- Refer to aid portion for those who have any queries or tackle our Assistance team.

- Put an digital signature on your Spokane Valley Washington 2025 1099-MISC aided by the enable of Indicator Instrument.

- Once the form is completed, push Finished.

- Distribute the all set variety by means of e-mail or fax, print it out or help save on the product.

PDF editor allows you to make adjustments with your Spokane Valley Washington 2025 1099-MISC from any world-wide-web connected equipment, personalize it in line with your requirements, indication it electronically and distribute in several methods.