Hi everyone, this is a video on how to print 1099s from QuickBooks Online. It's a different process than the QuickBooks desktop. Step one is to go to the Vendor Center and select which vendors are eligible for a 1099. You should pay them more than $600 in cash or checks if they were providing a service. You would want them to receive a 1099. So, we'll go to Lisa Advertising and edit the vendor. In the lower right-hand corner, there's a check for tax payments for 1099. Here, we'll put in Laura Lee's social security number. The reason we're using her social security number is that this company files as a sole proprietor on a 1040 form. If this was an LLC and Laura still filed her tax return on a 1040 form, then we would complete her first and last name. This I would leave blank. I would put her social security number in the lower right-hand corner. The IRS does not want the EIN number of the business if it's filed on a 1040 form. If Lisa Advertising was a partnership, we would leave the first and last name blank. These three fields are what will show up on the first line of the 1099. Now, let's assume it is filed as a partnership on a form 1065, which is not a 1040 form. We would want the first line of the 1099 to be Lisa Advertising LLC. And down below, we would want it to be a tax ID number. We'll hit save. So, as you're making payments to vendors for services, consider getting their W9 form before you give them the check, even if the check is below $600. So, at your end, you have all the information you need to prepare the 1099. Step...

Award-winning PDF software

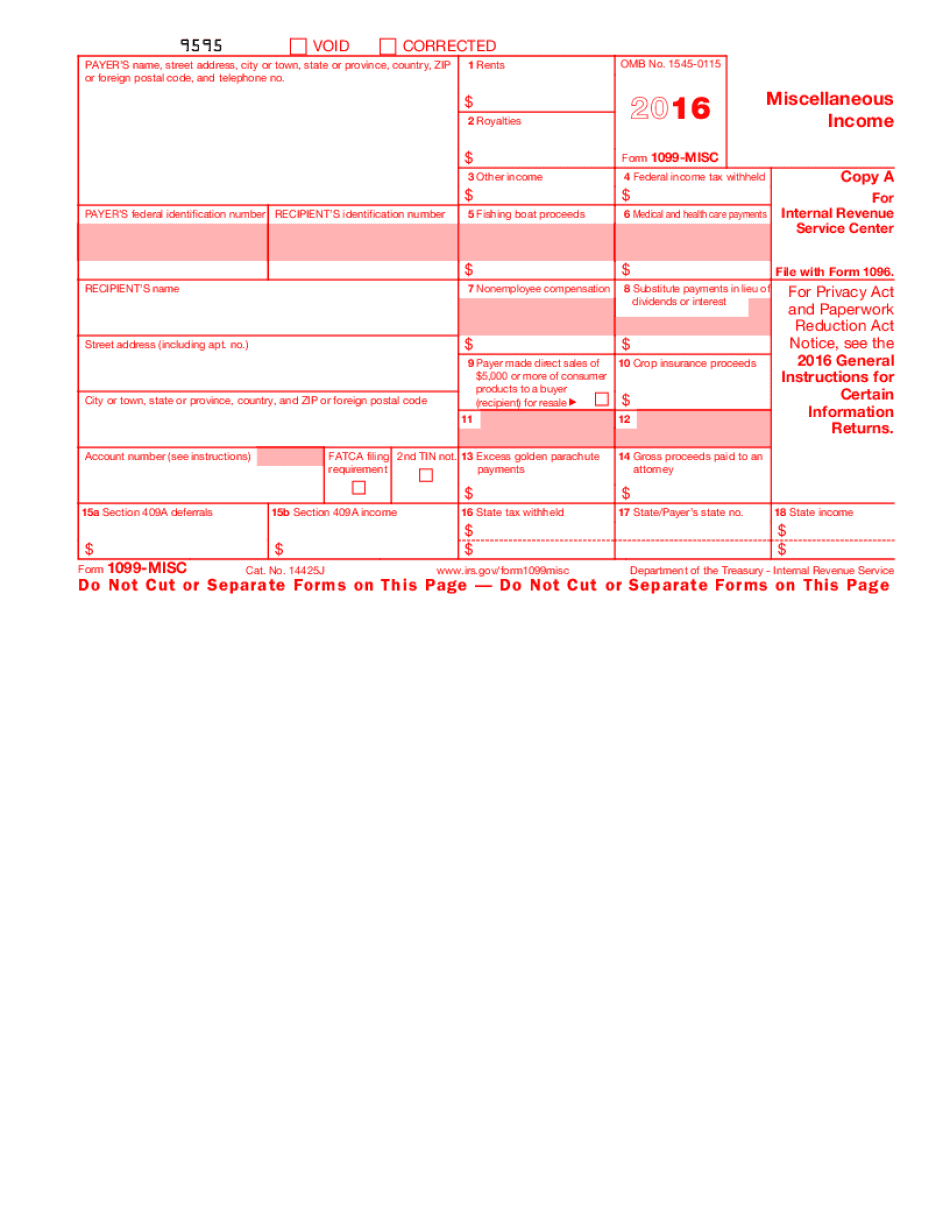

1099 misc online Form: What You Should Know

Filing 1099MISC Form 1098G Form 1098MISC 2025 Form 1098MISC 2025 Form 1098MISC 2025 Form 1098MISC 2025 Form 1098MISC 2025 Form 1098MISC 2025 Form 1099MISC 2025 Form 1099-MISC 2025 Form W-2 Form 1099-MISC 2025 Form 1099-MISC 2025 Form 1099-MISC 2025 Form 1099MISC 2025 Form 1099-MISC 2025 Form 1099-MISC 2025 Form 1099-MISC 2025 Form 1099-MISC 2025 Form 1099-MISC 2025 Form W-2 Certificate for Forms 1099, 1042-S, 1095, 1097 and 1098MISC (Rev. July 27, 2018) IRS Forms for Sales, Gift, Foreign and U.S. Earned Income Sales & Gift Taxes The Sales Tax is the largest corporate income tax collection in the country. Taxpayers have access to the latest Forms and instructions at IRS.gov/Forms. Taxpayers can claim a credit against their federal income tax if a taxable item is purchased for personal use. Taxpayers can claim a credit against their FICA tax if they earn wages or salaries. Taxpayers pay no sales tax when purchasing personal property. Income received through a partnership or S corporation is subject to state and local taxes where applicable. Sales & Gift Taxes are collected on the purchase of tangible personal property (or services that the seller has to sell). When a sale involves an exchange of money, a sale to an affiliate of the seller's business is treated as a sale to the public. Sales and gift taxes are collected for items that are used in the performance of a seller's trade or business. Examples are: sales of services for personal use, items purchased by a taxpayer to be used for personal use that the taxpayer actually uses for business purposes, equipment for business use, furniture or fixtures for business uses, and tangible personal property used to provide meals for the taxpayer's staff and volunteers to conduct their activities as a non-profit. Sales and gift taxes may also be collected from sellers when they receive payment for items they sell at a higher price than the original prices paid for them. Taxes are assessed based on the original purchase price plus any price adjustment resulting from any additional items that were sold. Payments from sellers who are selling to their customers in a retail store are not included in sales and gift taxes.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do 2025 IRS 1099-MISC, steer clear of blunders along with furnish it in a timely manner:

How to complete any 2025 IRS 1099-MISC online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your 2025 IRS 1099-MISC by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your 2025 IRS 1099-MISC from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing 1099 misc online