Award-winning PDF software

1099 filing Form: What You Should Know

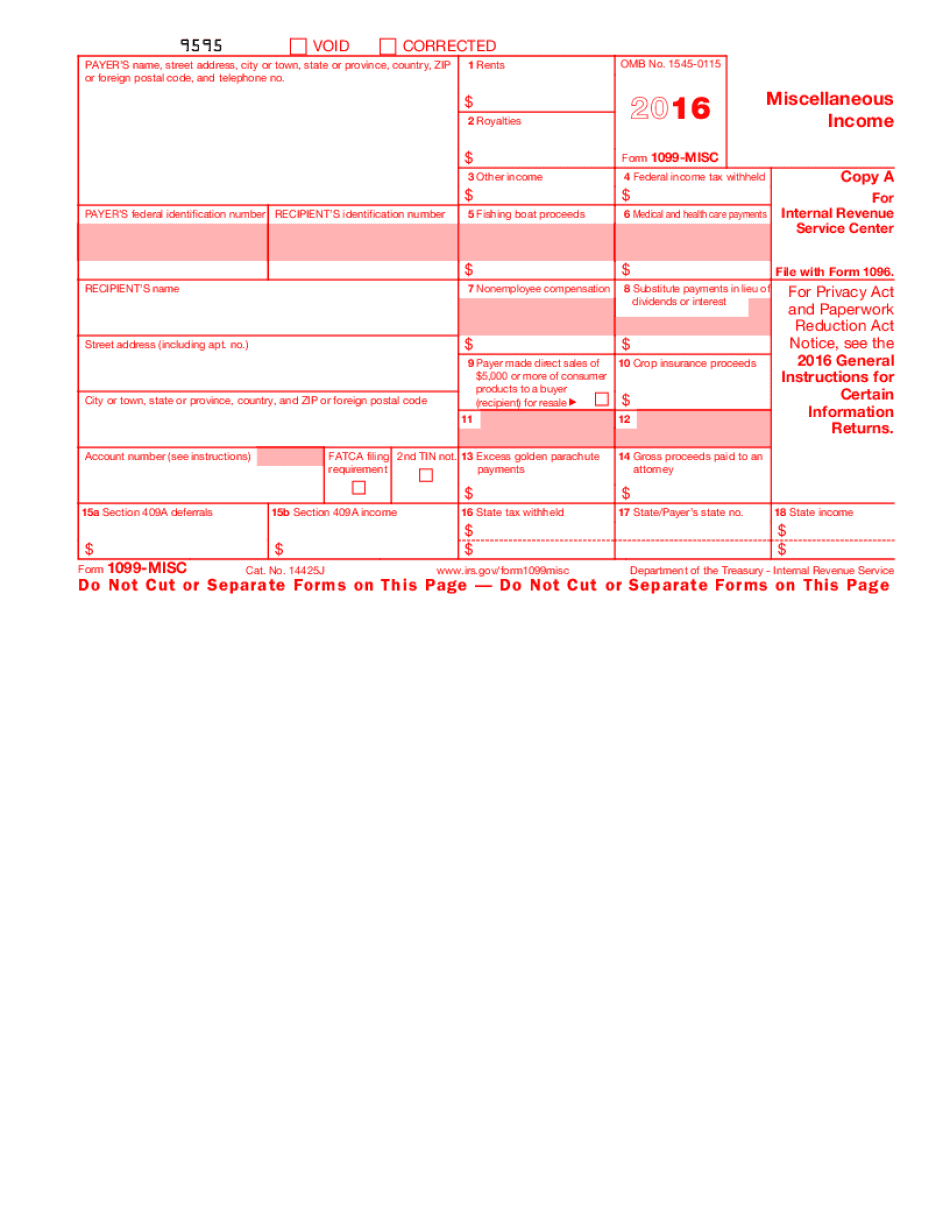

Filed by thousands of taxpayers, Tax1099 is a tax preparer program that offers a secure and convenient way for individuals and businesses to file their federal and state taxes electronically. How to Establish and Verify Your Existence as a Sole Proprietor or Business Partner of an Employer — Turbo Tax Tips and Videos What is a sole proprietor or partner? And how does one establish that status? TaxPrepTips.com goes to great lengths to help you figure that out. Can I Use a Corporation as a Sole Proprietor or Partnership? — Turbo Tax Tips and Videos TaxPrepTips.com goes to great lengths to help you figure that out. How to Pay Yourself and Schedule Your Deductions — TurboT ax Tutorials Use Turbo Tax Advanced Filers to make sure you pay yourself your required amounts on time. You can even manage your distributions from the LLC. Do all businesses have to file Form 1099-MISC? No. But most do. And even though the penalties for filing an erroneous or incomplete 1099 for an employer aren't nearly as stiff as for the self-employed, they still apply. Do you have income from a business? If so, you might want to take advantage of some special deductions and credits you may qualify for if you sell your business. Or...you could choose to put it in the business. Form 1099-MISC: What It Is and What It's Used For Form 1099-MISC is a summary of various payees the Form 1099-MISC was sent to during any five-day period over the course of any calendar year. It is used to claim certain unreported amounts as a miscellaneous income. What is the purpose of Form 1099-MISC? Tax 1099-MISC Form Description The purpose of Form 1099-MISC is to provide certain tax information to the recipient, so they can deduct certain miscellaneous amounts from their tax reporting for the year. Forms 1099-MISC are required only to determine whether an individual or business has received a miscellaneous income tax deduction. Form 1099-INT: What is it, and Where did it come from for U.S. citizens and residents? Form 1099-INT: Who is required to file? In order to claim U. S.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do 2025 IRS 1099-MISC, steer clear of blunders along with furnish it in a timely manner:

How to complete any 2025 IRS 1099-MISC online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your 2025 IRS 1099-MISC by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your 2025 IRS 1099-MISC from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.